SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) of theSecurities Exchange Act ofOF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantþ

☒ Filed by a Party other than the Registranto

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | ||||||||||||||||||||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | ||||||||||||||||||||||||

| ☐ | Definitive Proxy Statement | ||||||||||||||||||||||||

| ☐ | Definitive Additional Materials | ||||||||||||||||||||||||

| ☐ | Soliciting Material Pursuant to§240.14a-12 | ||||||||||||||||||||||||

RED LION HOTELS CORPORATION | |||||||||||||||||||||||||

| (Name of Registrant as Specified in Its Charter) | |||||||||||||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | |||||||||||||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | |||||||||||||||||||||||||

| ☒ | No Fee Required | ||||||||||||||||||||||||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11 | ||||||||||||||||||||||||

| (1) | Title of each class of securities to which transaction applies: | ||||||||||||||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | ||||||||||||||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||||||||||||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | ||||||||||||||||||||||||

Total fee paid: | |||||||||||||||||||||||||

| Fee paid previously with preliminary materials. | ||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

| (1) | Amount previously paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

PRELIMINARY PROXY - SUBJECT TO COMPLETION - DATED MARCH 23, 2020

April [●], 2020

Dear Shareholder:

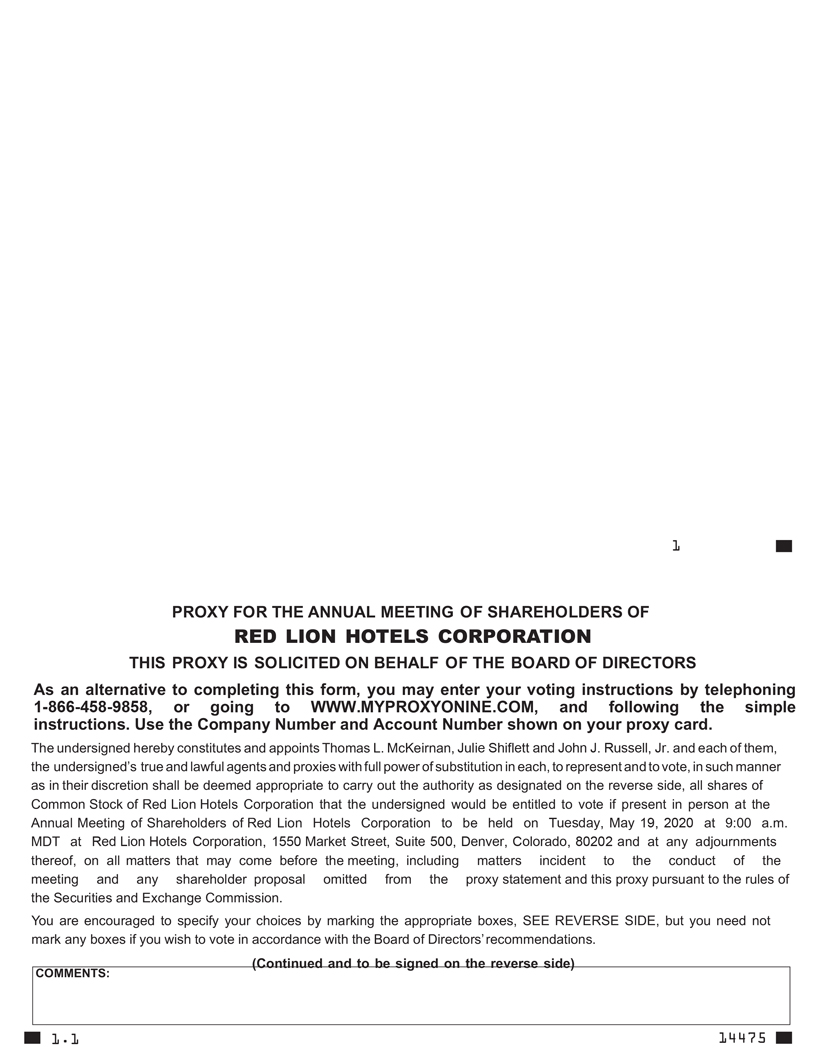

You are cordially invited to attend the 20112020 Annual Meeting of Shareholders of Red Lion Hotels Corporation at 8:9:00 a.m. MDT on Thursday,Tuesday, May 19, 2011,2020. The meeting will be held at the Red Lion Hotel at the Park, Skyline Ballroom, West 303 North River Drive, Spokane, Washington 99201.

The accompanying Notice of 20112020 Annual Meeting of Shareholders and Proxy Statement describe the matters to be presented at the meeting. In addition, management will speak on our developments of the past year and respond to comments and questions of general interest to shareholders.

It is important that your shares be represented and voted whether or not you plan to attend the annual meeting in person. You may vote by completing and mailing the enclosed proxy card or the form forwarded by your bank, broker or other holder of record. Voting by written proxy will ensure your shares are represented at the meeting.

| Sincerely, |

|

| R. Carter Pate |

| Chairman of the Board |

IMPORTANT

A proxy statement and WHITE proxy card are enclosed. All shareholders are urged to complete and mail the proxy card promptly. The enclosed envelope for return of the proxy card requires no postage. Any shareholder of record attending the meeting may personally vote on all matters that are considered, in which event the signed proxy will be revoked.

YOUR VOTE IS IMPORTANT, THAT YOUR STOCK BE VOTED.REGARDLESS OF THE NUMBER OF SHARES YOU OWN

If you need assistance voting your shares, please contact Red Lion’s proxy solicitor, Laurel Hill Advisory Group, LLC at888-742-1305.

PRELIMINARY PROXY - SUBJECT TO COMPLETION - DATED MARCH 23, 2020

NOTICE OF 20112020 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 19, 20112020

To the Shareholders of Red Lion Hotels Corporation:

The 20112020 Annual Meeting of Shareholders of Red Lion Hotels Corporation will be held at 8:9:00 a.m. MDT on Thursday,Tuesday, May 19, 2011,2020 at the Red Lion Hotel at the Park, Skyline Ballroom, West 303 North River Drive, Spokane, Washington 99201Hotels Corporation, 1550 Market Street, Suite 500, Denver, Colorado, 80202 for the following purposes:

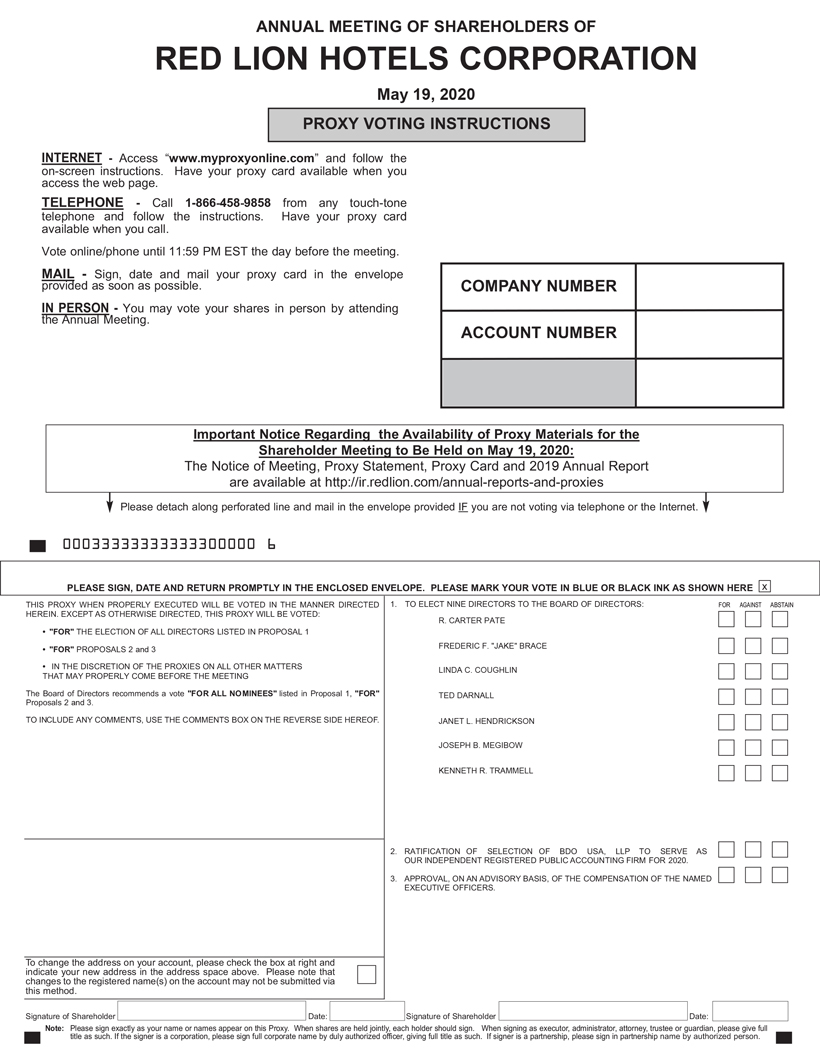

| (1) | Election of seven individuals to the Board of Directors; |

| (2) | Ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for 2020; |

| (3) | Advisory(non-binding) vote to approve executive compensation; and |

| (4) | Transaction of such other business as may properly come before the meeting and any adjournments thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

The Board of Directors has fixed March 31, 201124, 2020 as the record date for the meeting. Only shareholders of record at the close of business on that date will be entitled to notice of and to vote at the meeting.

Ouray Select, LP, a shareholder of record (“Ouray”), has provided notice to the Company of its intention to put forth individuals (the “Ouray Nominees”) for election as directors at the Annual Meeting of Shareholders. The Board is unanimously OPPOSED to the nominations of the Ouray Nominees and does not believe that election of these individuals is in the best interest of the Company or its shareholders.

You may receive solicitation materials from Ouray, including a proxy statement and proxy cards. The Board urges you not to sign or return or vote on any proxy cards sent to you by Ouray.

IT IS IMPORTANT THAT YOUR SHARES CANPROXIES BE VOTED ATRETURNED PROMPTLY. EVEN IF YOU PLAN TO ATTEND THE MEETING AND VOTE IN ACCORDANCE WITH YOUR INSTRUCTIONS. FOR SPECIFICPERSON, WE URGE SHAREHOLDERS TO PROMPTLY VOTE BY PHONE OR INTERNET FOLLOWING THE INSTRUCTIONS ON VOTING, PLEASE REFER TO THE ENCLOSED WHITE PROXY CARD OR TO COMPLETE, SIGN, DATE AND RETURN THE INFORMATION PROVIDEDWHITE PROXY CARD BY YOUR BANK, BROKER OR OTHER HOLDER OF RECORD. EVEN IF YOU VOTE YOUR PROXY, YOU MAY STILL VOTEMAIL IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BANK, BROKER OR OTHER HOLDER OF RECORD AND YOU WISH TO VOTE IN PERSON AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THE BANK, BROKER OR OTHER HOLDER OF RECORD.

For specific instructions on voting, please refer to the proxy card or the information provided by your bank, broker or other holder of record. Even if you vote your proxy, you may still vote in person if you attend the Boardmeeting. Please note, however, that if your shares are held of record by a bank, broker or other holder of record and you wish to vote in person at the meeting, you must obtain a proxy issued in your name from the bank, broker or other holder of record.

By Order of the Board of Directors |

|

| Thomas L. McKeirnan |

| Secretary |

Denver, Colorado

April [15][•], 2011

The 20102019 Annual Report of Red Lion Hotels Corporation accompanies thisProxy Statement. proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting

to Be Held on May 19, 2011:2020:

The Notice of Meeting, Proxy Statement, Proxy Card and 20102019 Annual Report

are available at

https://rlhcorp.gcs-web.com/annual-reports-and-proxies.

Important Notice regardingCOVID-19: We intend to hold the Annual Meeting in person. However, we are monitoring the protocols that federal, state, and local governments may recommend or require in light of the evolving coronavirus(COVID-19) situation. As a result, we may impose additional procedures or limitations on meeting attendees (beyond those described herein) or may decide to hold the Annual Meeting in a different location or solely by means of remote communication (i.e., a virtual-only meeting). In the event we determine it is necessary or appropriate to take additional steps regarding how we conduct the Annual Meeting, we will announce this decision in advance, and details will be posted on our website at http://investor.shareholder.com/rlhcorp/annuals.cfmir.redlion.com and filed with the SEC..

PRELIMINARY PROXY - SUBJECT TO COMPLETION - DATED MARCH 23, 2020

201 West North River Drive,1550 Market Street, Suite 100Spokane, Washington 99201425

Denver, Colorado 80202

20112020 PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

General

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of Red Lion Hotels Corporation, a Washington corporation, for use at the 20112020 Annual Meeting of Shareholders to be held at 8:9:00 a.m. local timeMDT on Thursday,Tuesday, May 19, 2011, and2020 at any adjournments thereof. The meeting will be held at the Red Lion Hotel at the Park, Skyline Ballroom, West 303 North River Drive, Spokane, Washington 99201. The following are directions to the hotel from Interstate 90 East or West:

Proxies are solicited to give all shareholders of record an opportunity to vote on matters properly presented at the meeting. This proxy statement and the accompanying proxy card are first being mailed on or about April [15][●], 20112020 to all shareholders entitled to vote at the meeting.

Who Can Vote

You are entitled to vote at the meeting if you were a holder of record of our common stock, $.01 par value, at the close of business on March 31, 2011.24, 2020. Your shares may be voted at the meeting only if you are present in person or represented by a valid proxy.

For the ten days prior to the meeting, a list of shareholders entitled to vote at the meeting will be available during ordinary business hours for examination by any shareholder, for any purpose germane to the meeting, at our principal executive office at 201 West North River Drive,1550 Market Street, Suite 100, Spokane, Washington 99201.425, Denver, Colorado 80202. This list will also be available at the meeting.

Shares Outstanding and Quorum

At the close of business on March 31, 2011,24, 2020, there were 18,993,267[●] shares of our common stock outstanding and entitled to vote. A majority of the outstanding shares of our common stock, present in person or represented by proxy, will constitute a quorum at the meeting.

Proxy Card and Revocation of Proxy

You may vote by completing and mailing the enclosed proxy card. If you sign the proxy card but do not specify how you want your shares to be voted, your shares will be voted by the proxy holders named in the enclosed proxy (i) “FOR” the proposal to amend our Articles of Incorporation to declassify the Board; (ii) “FOR”“FOR” election of the threeseven director nominees named below; (iii) “FOR”(ii) “FOR” ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for 2011; (iv) “FOR”2020; and (iii) “FOR” approval, on an advisory basis, of the compensation of our named executive officers; and (v) “FOR” an annual advisory vote on executive compensation.officers. If one or more of the director nominees should become unavailable for election prior to the meeting, an event that currently is not anticipated by the Board, the proxies may be voted in favor of the election of a substitute nominee or nominees proposed by the Board.

1

The proxy holders named in the enclosedWHITE proxy are authorized to vote in their discretion on any other matters that may properly come before the meeting or any adjournments thereof. At the time this proxy statement went to

1

If you vote by proxy, you may revoke that proxy at any time before it is voted at the meeting. Shareholders of record may revoke a proxy by delivering a written notice of revocation or a duly executed proxy bearing a later date to our Secretary at our principal executive office at 201 West North River Drive,1550 Market Street, Suite 100, Spokane, Washington 99201,425, Denver, Colorado 80202, or by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy. If your shares are held in the name of a broker, bank or other holder of record, you may change your vote by submitting new voting instructions to that holder of record. Please note that if your shares are held of record by a broker, bank or other holder of record and you decide to attend andthe meeting, you may vote at the meeting your vote in person at the meeting will not be effective unlessonly if you present a legal proxy issued in your name from that holder of record.

Voting of Shares

Shareholders of record as of the close of business on March 31, 201124, 2020 are entitled to one vote for each share of our common stock held on all matters to be voted upon at the meeting. You may vote by attending the meeting and voting in person or by completing and mailing the enclosed proxy card or the form forwarded by your bank, broker or other holder of record. If your shares are held by a bank, broker or other holder of record, please refer to the instructions they provide for voting your shares. All shares entitled to vote and represented by properly executed proxies that are received before the polls are closed at the meeting and are not revoked or superseded will be voted at the meeting in accordance with the instructions indicated on those proxies.YOUR VOTE IS IMPORTANT.

Counting of Votes

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and brokernon-votes. Shares held by persons attending the meeting but not voting, shares represented by proxies that reflect abstentions on one or more proposals and brokernon-votes will be counted as present for purposes of determining a quorum.

Abstentions on any of the proposals under consideration at the annual meeting will generally not count as votes “cast”. A brokernon-vote occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not receive voting instructions from the beneficial owner and does not have (or elects not to exercise) discretionary authority to vote the shares without such instructions. The effect of abstentions and brokernon-votes on each of the proposals on the agenda for the annual meeting is discussed below in the sections discussing those proposals.

Solicitation of Proxies

We will bear the expense of preparing, printing and distributing proxy materials to our shareholders. We will also furnish copies of the proxy materials to banks, brokers and other holders of record holding in their names shares of our common stock that are beneficially owned by others, so that the proxy materials can be forwarded to those beneficial owners. We will reimburse these banks, brokers and other holders of record for costs incurred in forwarding the proxy materials to the beneficial owners. In addition, the Company has retained Laurel Hill Advisory Group, LLC to assist with the solicitation of proxies for a fee of $25,000, plus reimbursement of certainout-of-pocket expenses.

2

PROPOSAL 1

APPROVAL OF AMENDMENTS TO OUR ARTICLES OF INCORPORATION

Board Structure

Under our current Articles of Incorporation andBy-Laws, the Board consists of from three to thirteen directors, as determined from time to time by resolution of the Board. The number of directors that currently constitutes the Board is divided into three classes. Each class consists, as nearly as possible, of one-thirdseven. At the recommendation of the total number ofNominating and Corporate Governance Committee, the Board has nominated for election at the annual meeting existing directors with members ofFrederic F “Jake” Brace, R. Carter Pate, Ted Darnall, and Joseph B. Megibow, each class servingto hold office for a three-year term. Each year only one class of directors is subject to a shareholder vote.

2

Voting for Directors

3

4

In a contested election, if a quorum is present, the persons receiving a plurality of the votes cast shall be elected directors. As Ouray has not delivered a notice of withdrawal with respect to its notice to nominate individuals for election to the Board who receiveof Directors, the greatest number ofBoard has determined that this is a contested election and plurality voting will apply.

The following will not be considered votes cast inand will not count towards the election of directors by the shares entitled to vote andany director nominee:

a share whose ballot is marked as abstain;

a share otherwise present in person or by proxy at the meeting will be elected directors. Anbut for which there is an abstention;

a share otherwise present at the meeting as to which a shareholder of record gives no authority or direction; and

brokernon-votes.

Because an abstention from voting for a nominee may makeis not treated as a vote cast, it less likely thatwill have no effect on the nominee will be oneelection of the three nominees who receive the greatest number of votes cast.nominee. Brokers no longerdo not have discretionary authority to vote in the election of directors. If a broker holding shares for a beneficial owner does not receive instructions from the beneficial owner on how to vote in the election, the broker will submit anon-vote. Because a brokernon-vote which also may make is not treated as a vote cast, it less likely that a nominee will be onehave no effect on the election of the three nominees who receive the greatest number of votes cast.

Set forth below is biographical information for each nominee andof the Company’s nominees for each director whose term of office will continue after the meeting. Except as disclosed in these biographies, theredirector. There are no family relationships among any of our directorsthe nominees or among any of our directorsthe nominees and our executive officers.

Nominees for Election at the Annual Meeting

Richard L. BarbieriFrederic F. “Jake” Brace, age 62, was appointed to the Board on July 17, 2019. Mr. Brace has over 30 years of experience in strategy, finance, restructuring and transformation for numerous industries including airlines,

3

health care, retail, E&P, electrical production, hospitality and real estate. He currently provides advisory services through his firm, Sangfroid Advisors, an international turnaround, restructuring and transformation consultancy. He was formerly the President and CEO of Laser Spine Institute and, before that, Midstates Petroleum, a Tulsa-based E&P company. Previous to those positions, Mr. Brace served as President of Niko Resources, a Canadian E&P company, Chief Administrative Officer of The Great Atlantic and Pacific Tea Co. (A&P grocery stores) and the Chief Financial Officer of UAL Corporation. (In December 2010, The Great Atlantic & Pacific Tea Company filed for protection under Chapter 11 of the Bankruptcy Code; it emerged from bankruptcy in March 2012). Mr. Brace currently sits on the board of Anixter International (NYSE: AXE) and Niko Resources (OTC: NKRSF). He was previously on the boards of various public and private companies including iHeart Media, Sequa, GenOn, Standard Register, Edison Mission Energy, Bally Total Fitness, Neff Rental, Sirva, Galileo International and Bearing Point among others.

Linda C. Coughlin, age 68, has been nominated for election at the 2020 Annual Meeting of Shareholders. Ms. Coughlin is a veteran operating executive specializing in the leadership of disruptive changes to the status quo such as restructurings, downsizings, internalstart-ups and the planning for and implementation of mergers, acquisitions, IPO’s, joint ventures and divestitures and rebranding initiatives. Since 2008, Ms. Coughlin has served as the CEO of Great Circle Associates, LLC, a consulting firm she founded that provides interim executive and individual advisory services. From 2004 until 2007, she served as Chief Administrative Officer and member of the Executive Committee at Cendant Corporation, where she was responsible for global contact center operations, corporate marketing, information technology, global procurement, human resources and corporate real estate. From 2002-2004, she served as the President and Vice Chair of the Board of Directors at Linkage, Inc., a global consulting firm, and from 1986 to 2002, she held various roles with Scudder Investments, a global investment management firm, including serving as President of the Americas Mutual Fund Groups and Chair of the Board of the AARP, Scudder and Kemper Funds. Ms. Coughlin began her career at American Express Company and Citibank where she spent 10 years in a variety of strategy, marketing, telephone operations and corporate communications roles. She has 12 years of public and private company board experience, and currently serves as a Director and member of the Audit and Nomination and Governance Committees of The China Fund, Inc. (NYSE:CHN). Ms. Coughlin holds a BA in Economics, summa cum laude from Fordham University.

Ted Darnall,age 68,62,was appointed to the Board on July 31, 2018.Mr. Darnall is a30-year veteran of the hospitality industry. Since April 2015, he has served as CEO of HEI Hotels and Resorts Lodging and Technical Services Company, the company responsible for all of HEI lodging services, management, design, renovation and technical services, and served as the Chief Operating Officer of HEI Hotels and Resorts from October 2006 to April 2015. Prior to joining HEI Hotels and Resorts, Mr. Darnall was with Starwood Hotels and Resorts Worldwide for 10 years where he held various executive positions, including Chief Operating Officer of Starwood Lodging Corporation, President of North America Operations and most recently, President of Starwood Real Estate Group. Prior to joining Starwood, Mr. Darnall was with Interstate Hotels and Resorts for over 14 years, reaching the position of Senior Vice President, Operations. Mr. Darnall began his hospitality career with Marriott International, where he held a number of management positions.

Janet L. Hendrickson, age 65, has been nominated for election at the 2020 Annual Meeting of Shareholders. Ms. Hendrickson is an experienced executive and corporate director that brings deep expertise to strategic leadership, business development, fiscal management, capital structure strategies, operations, and people development. She is currently serving as the Chief Operating Officer of Toaster Labs Inc., dba Pulse, a position she has held since 2019. From 2015-2018, Ms. Hendrickson served as Regional Managing Director of Ascent Private Capital Management, and she was aco-founder and Managing Partner of Denny Hill Capital, an early stage venture capital firm with a consumer focused investment strategy, from 2002-2015. Ms. Hendrickson currently sits on the board of The Commerce Bank of Washington, a banking institution serving Washington state, one of eight community banks under Zion Bancorporation (NASDAQ: ZION) and the Virginia Mason Health System. She previously served on the board of Tully’s Coffee from 2009 to 2013, including as Lead Director, and for private companies Butter London, Toosum Foods, Reklaim, PhotoRocket, and Cleverset,

4

among others. Ms. Hendrickson was recognized in 2011 by the Puget Sound Business Journal as a Woman of Influence. She began her career in finance and operations attaining the position of CFO. Ms. Hendrickson earned her graduate degree in public administration from the University of Washington, as well as her Bachelor of Arts.

Joseph B. Megibow, age 51, has been a director since 1978. HeMarch 2017. Mr. Megibow is currently the brother of Donald K. Barbieri. From 1994 until December 2003, he served as our full-time General Counsel, first as Vice President, then Senior Vice President and Executive Vice President. From 1978 to 1995, Mr. Barbieri served as legal counsel and Secretary, during which time he was first engaged in the private practice of law at Edwards and Barbieri, a Seattle law firm, and then at Riddell Williams P.S., a Seattle law firm, where he chaired the firm’s real estate practice group. Mr. Barbieri has also served as chairman of various committees of the Washington State Bar Association and the King County (Washington) Bar Association, and as a member of the governing board of the King County bar association. He also served as Vice Chairman of the Citizens’ Advisory Committee to the Major League Baseball Stadium Public Facilities District in Seattle in 1996 and 1997. Mr. Barbieri’s professional experience in real estate matters and in the hospitality industry, combined with his legal training and institutional knowledge of the company, provide the Board with important and relevant perspective on the company’s business.

5

Directors Continuing in Office Until the 2012 Annual Meeting of Shareholders

Kenneth R. Trammell, age 59, has been nominated for election at the Inland Northwest Council, Boy Scouts of America. Mr. Stanton’s executive level experience and his extensive knowledge

6

5

Director and Director Nominee Qualifications; Diversity

Our Nominating and Corporate Governance Committee assists the Board in reviewing the business and personal background of each of our directors with respect to our company’s business and business goals. The committee generally considers diversity as one of several factors relating to overall composition when making nominations to our Board. While we do not have a formal policy governing how diversity is considered, the committee generally considers diversity by examining the entire Board membership and, when making nominations to our Board, by reviewing the diversity of the entire Board. The committee construes Board diversity broadly to include many factors. As a result, the committee strives to ensure that our Board is composed of individuals with a variety of different opinions, perspectives, personal, professional and industry experience, and backgrounds, skills and expertise.

7

Brace | Coughlin | Darnall | Hendrickson | Megibow | Pate | Trammell | ||||||||||||||||||||||||||

Senior leadership/ CEO/COO experience | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Business development experience | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Financial expertise/CFO | ||||||||||||||||||||||||||||||||

| ✓ | ✓ | |||||||||||||||||||||||||||||||

Outside public board experience | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||

Independence | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Hotel and travel industry experience | ||||||||||||||||||||||||||||||||

| ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||

Marketing/sales expertise | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Government expertise | ||||||||||||||||||||||||||||||||

| ✓ | ✓ | |||||||||||||||||||||||||||||||

Mergers & acquisitions & investment experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

Demonstrated integrity-personal and professional | ✓ | ✓ | ||||||||||||||||||||||||||||||

| ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||

Real estate expertise | ✓ | ✓ | ||||||||||||||||||||||||||||||

Franchising expertise | ✓ | |||||||||||||||||||||||||||||||

Digital marketing and analytics expertise | ✓ | ✓ | ||||||||||||||||||||||||||||||

Technology expertise | ✓ | |||||||||||||||||||||||||||||||

| ✓ | ||||||||||||||||||||||||||||||||

We have concluded that all of our directors, including thedirector nominees for election at the annual meeting, have the skills, experience, knowledge and personal attributes that are necessary to effectively serve on our Board and to contribute to the overall success of our company. We believe that the diverse backgroundbackgrounds of each of our Board members ensuresthese nominees will ensure that we have a Board that has a broad range of industry-related knowledge, experience and business acumen.

6

PROPOSAL 3

2

RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected BDO USA, LLP to serve as our independent registered public accounting firm for 20112020 and has further directed that this selection be submitted for ratification by our shareholders at the annual meeting. BDO USA, LLP has audited our financial statements since 2001. Representatives of the firm are expected to be present at the meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions from shareholders. Unless instructed to the contrary, the proxies solicited hereby will be voted for the ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for 2011.

Shareholder ratification of the selection of BDO USA, LLP as our independent registered public accounting firm is not required by ourBy-Laws or otherwise. However, the Board is submitting the selection of the firm to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may select a different accounting firm at any time during the year if the Audit Committee determines that such a change would be in our best interests and that of our shareholders.

Each share of common stock is entitled to one vote on the proposal to ratify the selection of BDO USA, LLP and will be given the option to vote “FOR” or “AGAINST” the proposal or to “ABSTAIN.” Unless otherwise directed, it is the intention of the proxy holders named in the enclosed proxy to vote the proxies received by them FOR“FOR” this proposal.

8

Brokers do not have discretionary authority to vote on Proposal 2. If a broker holding shares for a beneficial owner does not receive instructions from the beneficial owner on how to vote on this proposal, the broker will submit anon-vote.

The Board recommends a vote “FOR” RATIFICATION OF THE SELECTION OFratification of the selection of BDO USA, LLP.

7

PROPOSAL 4

3

ADVISORY VOTE ONTO APPROVE EXECUTIVE COMPENSATION

As required by Section 14A of the Securities Exchange Act of 1934, the Board is submitting a separate resolution, to be voted on by shareholders in anon-binding vote, to approve on an advisory basis the executive compensation of our named executive officers. The text of the resolution is as follows:

“RESOLVED, that the shareholders approve, on an advisory basis, the compensation of the named executive officers as disclosed in this proxy statement under the captions “Compensation Discussion and Analysis” andcaption “Executive Compensation”.

As described in this proxy statement under Executive Compensation Discussion and Analysis, our compensation program is designed to focus executives on the achievement of specific annual and long-term goals. We structure the goals to align executives’ interests with those of shareholders by rewarding performance that maintains and improves shareholder value.

The following features of the compensation structure reflect this approach:

Our executive compensation program has both short- and long-term components.

The annual cash incentive component focuses on one or more specific performance goals and allows for discretionary compensation based on performance not otherwise measured by the goals.

Our agreements with executives generally do not contain guarantees for salary increases,non-performance-based bonuses or equity compensation.

The Board believes that the current executive compensation program properly focuses our executives on the achievement of specific annual, long-term and strategic goals. The Board also believes that this program properly aligns the executives’ interests with those of shareholders.

Shareholders are urged to read the Executive Compensation Disclosure and Analysis section of this proxy statement, which discusses in greater detail how our compensation program advances the specific goals that we set.

Each share of common stock is entitled to one vote on Proposal 43 and will be given the option to vote “FOR” or “AGAINST” the proposal or to “ABSTAIN.” Unless otherwise directed, it is the intention of the proxy holders named in the enclosed proxy to vote the proxies received by them FOR“FOR” this proposal.

Brokers do not have discretionary authority to vote on Proposal 43. If a broker holding shares for a beneficial owner does not receive instructions from the beneficial owner on how to vote on this proposal, the broker will submit anon-vote.

Proposal 3 will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against the proposal. Abstentions from voting and brokernon-votes will have no impact on the outcome of this proposal.

The Board recommends a vote “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS.

of the compensation of the named executive officers.

Although the advisory vote on Proposal 43 isnon-binding, we expect that the Board and the Compensation Committee will review the results of the vote and, consistent with our record of shareholder engagement, take the outcome of the vote into consideration, along with other relevant factors, in making determinations concerning future executive compensation.

9

8

10

The following table sets forth certain information regarding the beneficial ownership of our common stock as of March 31, 201123, 2020 by: (i) each of our directors and nominees; (ii) each of our named executive officers; (iii) all of our directors, nominees and executive officers as a group; and (iv) each person known by us to beneficially own more than 5% of our common stock.

| Number of | Percentage of | |||||||

Beneficial Owner | Shares Owned (1) | Common Stock (1) | ||||||

| Columbia Pacific Opportunity Fund, LP (2) | 4,332,293 | 22.8 | % | |||||

| Dimensional Fund Advisors LP (3) | 1,574,299 | 8.3 | % | |||||

| Donald K. Barbieri (4) | 1,220,180 | 6.4 | % | |||||

| BlackRock, Inc. (5) | 1,113,526 | 5.9 | % | |||||

| Thomas L. McKeirnan (6) | 121,982 | * | ||||||

| Richard L. Barbieri | 79,523 | * | ||||||

| Ronald R. Taylor (7) | 57,921 | * | ||||||

| George H. Schweitzer (8) | 56,494 | * | ||||||

| Jon E. Eliassen (9) | 53,740 | * | ||||||

| Peter F. Stanton (7) | 44,696 | * | ||||||

| Ryland P. Davis | 33,068 | * | ||||||

| Raymond R. Brandstrom | 12,591 | * | ||||||

| Melvin L. Keating | 5,739 | * | ||||||

| Harry G. Sladich (10) | 2,324 | * | ||||||

| Dan Jackson | 0 | * | ||||||

All directors and executive officers as a group (12 persons) (11)(12) | 1,688,258 | 8.9 | % | |||||

Beneficial Owner | Number of Shares Owned(1) | Percentage of Common Stock(1) | ||||||

Coliseum Capital Management, LLC (2) | 4,200,871 | 16.7 | % | |||||

Dimensional Fund Advisors LP (3) | 2,054,883 | 8.2 | % | |||||

Blackrock, Inc. (4) | 1,733,567 | 6.9 | % | |||||

Frederic F. “Jake” Brace | 57,584 | * | ||||||

Ted Darnall | 43,270 | * | ||||||

Bonny Simi | 36,095 | * | ||||||

Joe Megibow | 28,005 | * | ||||||

Julie Shiflett (5) | 16,684 | * | ||||||

Amy Humphreys | 15,591 | * | ||||||

R. Carter Pate | 11,637 | * | ||||||

Gary Sims (6) | 2,195 | * | ||||||

John Russell | 0 | * | ||||||

Linda Coughlin | 0 | * | ||||||

Janet Hendrickson | 0 | * | ||||||

Kenneth Trammell | 0 | * | ||||||

All directors and executive officers as a group | 518,151 | 2.06 | % | |||||

| * | ||

Represents less than 1% of the outstanding common stock. | ||

| (1) | For purposes of this table, a person is deemed to have “beneficial ownership” of shares of common stock if such person has the right to acquire beneficial ownership of such shares within 60 | |

| (2) | The address for this beneficial owner is | |

| (3) | The address for this beneficial owner is | |

| (4) | ||

The address for this beneficial owner is |

Includes |

Includes | ||

Includes | ||

11

9

None.

CORPORATE GOVERNANCE

Corporate Governance Documents

The Board has adopted the following corporate governance documents:

Corporate Governance Guidelines;

Code of Business Conduct and Ethics;

Accounting and Audit Complaints and Concerns Procedures;

Statement of Policy with respect to Related Party Transactions; and

Charters for each of its standing committees, which include the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

We review each of these corporate governance documents annually and update them as necessary to reflect changes in regulatory requirements and evolving oversight practices. Copies of these documents are available online in the Investor Relations section of our website atwww.redlion.com.1 We will provide paper copies of these documents to any shareholder upon written request to our Secretary at our principal executive office at 201 West North River Drive,1550 Market Street, Suite 100, Spokane, Washington 99201.

Director Independence

The Board has determined that each ofnominee for election as a director at the following six members of the Boardannual meeting, other than Ted Darnell, is “independent” within the meaning of applicable listing standards of the New York Stock Exchange (the “NYSE”): Richard L. Barbieri, Raymond R. Brandstrom, Ryland P. Davis, Melvin L. Keating, Peter F. Stanton and Ronald R. Taylor.. Under the NYSE listing standards, a director is considered “independent” if the Board affirmatively determines that he or she has no material relationship with our company, either directly or as a partner, shareholder or officer of an organization that has a relationship with our company. Our Corporate Governance Guidelines contain categorical standards to assist the Board in making determinations of independence. A copy of these categorical standards is included inAppendix CA to this proxy statement. The Board has made an affirmative determination that each independent member of the six directors named aboveBoard satisfies these categorical standards.

12

The Board met seveneleven times in 2010.2019. All directors attended at least 75% of the total number of meetings of the Board and its committees on which they serve.

We encourage all of our directors to attend each annual meeting of shareholders. AllAt our 2019 annual meeting of shareholders, all 9 of our directors attended our 2010 annualwere in attendance at the meeting of shareholders.

Executive Sessions of the Board

It is our policy that the independent directors meet in executive session without members of management following regularly scheduled meetings of the Board, the non-management directors, which consist of the independent directors identified above and Donald K. Barbieri, generally meet in executive session without Mr. Eliassen or other members of management. Donald K. Barbieri, asBoard. The Chairman of the Board serves as the presiding director for these executive sessions. In addition, at least once each year, and generally at each quarterly meeting of the Board, the independent directors meet in executive session without any of the non-independent directors or members of management present.

10

Committees of the Board of Directors

We have three committees to assist the Board in fulfilling its responsibilities: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The following table shows the membership of each committee as of March 23, 2020:

Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||

R. Carter Pate(1) | ✓ | |||||

Frederic F. (Jake) Brace | ✓ | ✓ | ||||

Amy Humphreys(2) | Chair | ✓ | ||||

Joseph B. Megibow | ✓ | Chair | ||||

Bonny W. Simi(2) | Chair | ✓ |

| (1) | Chairman of the Board |

| (2) | Not standing for reelection. |

Audit Committee

The Audit Committee engages our independent registered public accounting firm, reviews with the firm the plans and results of the audit engagement, approves the audit andnon-audit services provided by the firm, reviews our financial statements, reviews our compliance with laws and regulations, receives and reviews complaints relating to accounting or auditing matters, considers the adequacy of our internal accounting controls, and produces a report for inclusion in our annual proxy statement. The members of the Audit Committee are Peter F. Stanton, Chairman, Raymond R. Brandstrom, Ryland P. Davis and Ronald R. Taylor.

The Board has determined that each member of the Audit Committee is financially literate under the current listing standards of the NYSE. The Board also has determined that each member of the Audit Committee qualifies as an “audit committee financial expert” as defined by applicable rules of the Securities and Exchange Commission. All members of the Audit Committee are considered independent because they satisfy the independence requirements for board members prescribed by the NYSE listing standards, including those set forth in RuleRule 10A-3 under the Securities Exchange Act of 1934, as amended.

Compensation Committee

The Compensation Committee discharges the responsibilities of the Board relating to compensation and evaluation of our President and Chief Executive Officer, or CEO, and other executive officers, makes recommendations to the Board regarding the compensation of directors, oversees the administration of our equity incentive plans and produces an annual report on executive compensation for inclusion in our annual proxy statement. The members of the Compensation Committee are Ronald R. Taylor, Chairman, Ryland P. Davis and Peter F. Stanton.

The processes and procedures of the Compensation Committee for considering and determining compensation for our executive officers and directors are as follows:

Compensation for our executive officers is generally determined annually during the first few months of the year.

| • | ||

With respect to our CEO, |

13

11

| • | Our Compensation Committee determines compensation for the other executive officers based on the recommendations of our CEO, evaluates the performance of our executive officers against performance goals established for the prior year, and | ||

The Compensation Committee has the sole authority to retain and compensate its own advisers.

The Compensation Committee reviews director compensation and benefits annually and makes recommendations to the Board with respect thereto.

The Compensation Committee has no authority to delegate any of the functions described above to any other persons.

The Board has reviewed the source of compensation received by each director serving on the Compensation Committee and determined that no director receives compensation from any person or entity that would impair his or her ability to make independent judgments about our company’s executive compensation. The Board has also reviewed all affiliations the directors serving on the Compensation Committee have with our company and its subsidiaries and affiliates and determined that there is no such relationship that places any of these directors under the direct or indirect control of our company or senior management, or creates a direct relationship between the director and members of our senior management, in each case of a nature that would impair his or her ability to make independent judgments about our company’s executive compensation.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for identifying and recommending to the Board for selection or nomination those individuals qualified to become members of the Board under the criteria established by our Corporate Governance Guidelines, periodically reviewing and making recommendations to the Board with regard to size and composition of the Board and its committees, recommending and periodically reviewing for adoption and modification by the Board our Corporate Governance Guidelines, and overseeing the evaluation of the Board and management. The members of the Nominating and Corporate Governance Committee are Ryland P. Davis, Chairman, Richard L. Barbieri, Peter F. Stanton and Ronald R. Taylor.

Directors may be nominated by the Board or by shareholders in accordance with ourBy-Laws. The Nominating and Corporate Governance Committee will review all proposed nominees for the Board, including those recommended by shareholders, in accordance with its charter, ourBy-Laws and our Corporate Governance Guidelines. The committee will review age (a minimum age of 21 is prescribed for directors under theBy-Laws), desired experience, mix of skills and other qualities to assure appropriate Board composition, taking into account the current Board members and the specific needs of our company and the Board. The committee will generally look for individuals who have displayed high ethical standards, integrity and sound business judgment. This process is designed to ensure that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business.

While the committee is authorized to retain a third party to assist in the nomination process, we have not paid a fee to any third party to identify or assist in identifying or evaluating potential nominees.

A shareholder of record can nominate a candidate for election to the Board by complying with the procedures in Section 3.3 of ourBy-Laws. Any shareholder of record who wishes to submit a nomination should review the requirements in the By-LawBy-Laws for nominations by shareholders, which are included in the excerpt from theBy-Laws attached asAppendix DB to this proxy statement. Any nomination should be sent to our Secretary at our principal executive office, 201 West North River Drive,1550 Market Street, Suite 100, Spokane, Washington 99201.425, Denver, Colorado 80202. Any recommendations from shareholders regarding director nominees should be sent to the Nominating and Corporate Governance Committee in care of our Secretary at the same address.

Leadership Structure

We believe it is the CEO’s responsibility to lead the company and it is the responsibility of the Chairman of the Board to lead the Board. As directors continue to have more oversight responsibilities than ever before, we

12

believe it is beneficial to have a separate chairman whose sole job is leading the Board. Accordingly, our Corporate Governance Guidelines currently provide that the Chairman of the Board cannot be an officer of the company. The Board retains the authority to modify this structure as and when appropriate to best address our company’s unique circumstances and to advance the best interests of all shareholders.

14

The Board’s role in overseeing our company’s risk is to satisfy itself, directly or through Board committees, that —

there are adequate processes designed and implemented by management such that risks have been identified and are being managed;

the risk management processes function as intended to ensure that our company’s risks are taken into account in corporate decision making; and

the risk management system is designed to ensure that material risks to our company are brought to the attention of the Board or an appropriate committee of the Board.

Each of our company’s risk management processes is reviewed periodically (but at least once a year) by either the Board or an appropriate committee. Committee chairs regularly report on committee meetings at the meetings of the full Board.

The Board has reviewed our company’s current risk management systems and processes and concluded that the current allocation of oversight responsibilities between the Board and its committees is adequate, so long as the committees continue to coordinate their risk oversight responsibilities, share information appropriately with the other members of the Board, and provide timely and adequate reports to the full Board. The Board will continually evaluate its risk oversight role.

Communications with the Board of Directors

Our annual meeting of shareholders provides an opportunity each year for shareholders to ask questions of, or otherwise communicate directly with, members of the Board on appropriate matters. Shareholders or other interested parties may contact the Chairman of the Board at any time by sending ane-mail tochairman@redlion.com. In addition, shareholders may communicate in writing with any particular director, any committee of the Board, or the directors as a group, by sending a written communication to our Secretary at our principal executive office, 201 West North River Drive,1550 Market Street, Suite 100, Spokane, Washington 99201.425, Denver, Colorado 80202. Copies of written communications received at such address will be provided to the Board or the relevant director unless such communications are considered, in the reasonable judgment of our Secretary, to be inappropriate for submission to the intended recipient(s). Examples of shareholder communications that would be considered inappropriate for submission to the Board include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to our business or communications that relate to improper or irrelevant topics. Communications concerning potential director nominees submitted by any of our shareholders will be forwarded to the Chairman of the Nominating and Corporate Governance Committee.

15

Anti-Hedging and Anti-Pledging

16

17

| Percentage of Base Salary | Award Payouts ($) | |||||||||||||||||||||||||||

| Threshold (1) | Target | Maximum | Threshold (1) | Target | Maximum | Actual | ||||||||||||||||||||||

| George H. Schweitzer | 0 | % | 30 | % | 100 | % | 0 | 63,000 | 210,000 | 0 | ||||||||||||||||||

| Dan Jackson (2) | 0 | % | 30 | % | 100 | % | 0 | 10,356 | 34,521 | 0 | ||||||||||||||||||

| Harry G. Sladich (2) | 0 | % | 30 | % | 100 | % | 0 | 32,955 | 109,849 | 0 | ||||||||||||||||||

| Thomas L. McKeirnan | 0 | % | 30 | % | 100 | % | 0 | 62,700 | 209,000 | 0 | ||||||||||||||||||

18

19

20

13

Summary Compensation Table

The following table sets forth summary information concerning the compensation awarded to, paid to or earned by our named executive officers for all services rendered in all capacities to us in 2008, 20092019 and 2010.

| Non-Equity | ||||||||||||||||||||||||||||||||

| Incentive | ||||||||||||||||||||||||||||||||

| Stock | Option | Plan | All Other | |||||||||||||||||||||||||||||

| Salary | Bonus | Awards | Awards | Compensation | Compensation | Total | ||||||||||||||||||||||||||

Name and Principal Position | Year | ($) | ($) | ($) (2) | ($) (2) | ($) | ($) (3) | ($) | ||||||||||||||||||||||||

| Jon Eliassen (4) | 2010 | 321,231 | 0 | 216,003 | 0 | 0 | 52,929 | 590,163 | ||||||||||||||||||||||||

| President and Chief | ||||||||||||||||||||||||||||||||

| Executive Officer | ||||||||||||||||||||||||||||||||

| George H. Schweitzer | 2010 | 192,308 | 0 | 80,003 | 0 | 0 | 18,351 | 290,662 | ||||||||||||||||||||||||

| Executive Vice | 2009 | 208,461 | 0 | 77,362 | 0 | 0 | 22,365 | 308,188 | ||||||||||||||||||||||||

| President and Chief | 2008 | 148,615 | 0 | 37,497 | 138,995 | 0 | 18,241 | 343,348 | ||||||||||||||||||||||||

| Operating Officer, | ||||||||||||||||||||||||||||||||

| Hotel Operations | ||||||||||||||||||||||||||||||||

| Dan R. Jackson (5) | 2010 | 24,231 | 0 | 63,000 | 0 | 0 | 2,115 | 89,346 | ||||||||||||||||||||||||

| Executive Vice | ||||||||||||||||||||||||||||||||

| President, Chief | ||||||||||||||||||||||||||||||||

| Financial Officer | ||||||||||||||||||||||||||||||||

| Harry G. Sladich (6) | 2010 | 101,539 | 0 | 66,002 | 0 | 0 | 5,445 | 172,986 | ||||||||||||||||||||||||

| Executive Vice | ||||||||||||||||||||||||||||||||

| President, Sales and | ||||||||||||||||||||||||||||||||

| Marketing | ||||||||||||||||||||||||||||||||

| Thomas L. McKeirnan | 2010 | 191,392 | 0 | 79,619 | 0 | 0 | 8,316 | 279,327 | ||||||||||||||||||||||||

| Senior Vice President, | 2009 | 207,469 | 0 | 76,991 | 0 | 0 | 8,463 | 292,923 | ||||||||||||||||||||||||

| General Counsel and | 2008 | 206,808 | 0 | 20,688 | 52,140 | 0 | 7,702 | 287,338 | ||||||||||||||||||||||||

| Corporate Secretary | ||||||||||||||||||||||||||||||||

| Anupam Narayan (7) | 2010 | 0 | 0 | 0 | 0 | 0 | 1,215,307 | 1,215,307 | ||||||||||||||||||||||||

| Former President and | 2009 | 357,363 | 0 | 331,543 | 0 | 0 | 6,051 | 694,957 | ||||||||||||||||||||||||

| Chief Executive | 2008 | 345,715 | 0 | 89,550 | 247,324 | 0 | 5,496 | 688,085 | ||||||||||||||||||||||||

| Officer and Director | ||||||||||||||||||||||||||||||||

| Anthony F. Dombrowik (8) | 2010 | 144,231 | 0 | 66,669 | 0 | 0 | 6,566 | 217,466 | ||||||||||||||||||||||||

| Former Senior Vice President, | 2009 | 173,718 | 0 | 72,525 | 0 | 0 | 8,463 | 254,706 | ||||||||||||||||||||||||

| Chief Financial Officer | 2008 | 164,980 | 0 | 17,323 | 43,658 | 0 | 7,702 | 233,663 | ||||||||||||||||||||||||

| Name and Principal Position | Year | Salary ($) | Stock Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | All Other Compensation ($)(3) | Total ($) | ||||||||||||||||||

John J. Russell, Jr., Interim Chief | 2019 | $ | 15,535 | �� | — | $ | 15,535 | |||||||||||||||||

Gregory T. Mount Former President and Chief Executive Officer (5) | | 2019 2018 |

| $ $ | 493,985 548,500 |

| $ $ | 1,112,002 1,111,997 |

| | — 465,492 |

| | 556,000 — |

| $ $ | 2,161,987 2,126,639 |

| ||||||

Julie Shiflett, | 2019 | $ | 346,304 | $ | 1,083,202 | — | — | $ | 1,429,506 | |||||||||||||||

Gary Sims (7) Executive Vice President, | | 2019 2018 |

| $ $ | 350,150 168,269 |

| $ $ | 279,996 981,200 |

| | — 91,131 |

| | — 18,751 |

| $ $ | 630,146 1,259,172 |

| ||||||

Paul Sacco (8)(9) Former Executive Vice | | 2019 2018 |

| $ $ | 338,942 338,077 |

| $ $ | 300,002 1,145,193 |

| | — 109,885 |

| | 211,250 85,106 |

| $ $ | 850,194 1,678,261 |

| ||||||

| (1) | Amounts in this column reflect the | |

| (2) | Amounts in |

| (3) | Unless otherwise disclosed, the total value of all |

| (4) | Mr. | |

| (5) | Mr. Mount left the Company on November 8, 2019. Per the terms of his employment offer letter with the Company, Mr. Mount was entitled to receive a lump sum payment equal to one year of his base salary, or $566,000. This was paid to Mr. Mount in November 2019 and is included in the “All Other Compensation” column above. |

14

| (6) | Ms. Shiflett was hired | |

21

| (7) | Mr. |

| (8) | Mr. Sacco left the Company effective November 7, 2019. Per the terms of his | |

| All Other | ||||||||||||||||||||||||||

| Stock | ||||||||||||||||||||||||||

| Awards: | Grant | |||||||||||||||||||||||||

| Number | Date Fair | |||||||||||||||||||||||||

| Estimated Possible Payouts Under | of Shares | Value of | ||||||||||||||||||||||||

| Non-Equity Incentive Plan Awards (1) | of Stock | Stock | ||||||||||||||||||||||||

| Threshold | Target | Maximum | or Units | Awards | ||||||||||||||||||||||

Name | Type of Award | Grant Date (2) | ($) (3) | ($) | ($) | (#) (4) | ($) | |||||||||||||||||||

| Jon E. Eliassen | Restricted Stock Award | 5/19/10 | 30,423 | 216,003 | ||||||||||||||||||||||

| George H. Schweitzer | Annual Incentive Award | 0 | 63,000 | 210,000 | ||||||||||||||||||||||

| Restricted Stock Award | 5/19/10 | 11,268 | 80,003 | |||||||||||||||||||||||

| Dan Jackson (5) | Restricted Stock Award | 11/15/10 | 10,356 | 34,521 | 8,400 | 63,000 | ||||||||||||||||||||

| Harry G. Sladich (5) | Restricted Stock Award | 5/19/10 | 32,955 | 109,849 | 9,296 | 66,002 | ||||||||||||||||||||

| Thomas L. McKeirnan | Annual Incentive Award | 0 | 62,700 | 209,000 | ||||||||||||||||||||||

| Restricted Stock Award | 5/19/10 | 11,214 | 79,619 | |||||||||||||||||||||||

| Anupam Narayan (6) | ||||||||||||||||||||||||||

| Anthony F. Dombrowik (7) | Annual Incentive Award | 0 | 52,500 | 175,000 | ||||||||||||||||||||||

| Restricted Stock Award | 5/19/10 | 9,390 | 66,669 | |||||||||||||||||||||||

| (9) | Mr. Sacco was promoted to Executive Vice President, President of | |

22

The following table sets forth summary information regarding the outstanding equity awards held by each of our named executive officers at December 31, 2010.

| Option Awards(1) | Stock Awards(1) | |||||||||||||||||||||||

| Number | Market | |||||||||||||||||||||||

| of | Number of | Number of | Value of | |||||||||||||||||||||

| Securities | Securities | Shares or | Shares or | |||||||||||||||||||||

| Underlying | Underlying | Units of | Units of | |||||||||||||||||||||

| Unexercised | Unexercised | Option | Stock That | Stock That | ||||||||||||||||||||

| Options | Options | Exercise | Option | Have Not | Have Not | |||||||||||||||||||

| (#) | (#) | Price | Expiration | Vested | Vested | |||||||||||||||||||

Name | Exercisable | Unexercisable | ($) | Date | (#) | ($) (2) | ||||||||||||||||||

| Jon E. Eliassen | 30,423 | (3) | 242,776 | |||||||||||||||||||||

| George H. Schweitzer | 22,500 | 22,500 | (4) | 8.80 | 4/1/18 | |||||||||||||||||||

| 2,131 | (5) | 17,005 | ||||||||||||||||||||||

| 12,849 | (6) | 102,535 | ||||||||||||||||||||||

| 11,268 | (3) | 89,919 | ||||||||||||||||||||||

| Dan Jackson | 8,400 | (7) | 67,032 | |||||||||||||||||||||

| Harry G. Sladich | 9,296 | (3) | 74,183 | |||||||||||||||||||||

| Thomas L. McKeirnan | 10,451 | 0 | 5.98 | 7/1/13 | ||||||||||||||||||||

| 25,000 | 0 | 5.10 | 11/19/14 | |||||||||||||||||||||

| 7,500 | 0 | 7.46 | 11/10/15 | |||||||||||||||||||||

| 11,447 | 0 | 12.21 | 11/21/16 | |||||||||||||||||||||

| 9,761 | 3,253 | (8) | 13.00 | 5/17/17 | ||||||||||||||||||||

| 11,000 | 11,000 | (9) | 8.74 | 5/22/18 | ||||||||||||||||||||

| 366 | (10) | 2,921 | ||||||||||||||||||||||

| 1,196 | (11) | 9,544 | ||||||||||||||||||||||

| 12,787 | (6) | 102,040 | ||||||||||||||||||||||

| 11,214 | (3) | 89,488 | ||||||||||||||||||||||

| Anupam Narayan (12) | ||||||||||||||||||||||||

| Anthony F. Dombrowik (13) | 6,511 | 12.21 | 11/21/16 | |||||||||||||||||||||

| 6,936 | 13.00 | 5/17/17 | ||||||||||||||||||||||

| 9,211 | 8.74 | 5/22/18 | ||||||||||||||||||||||

| Option Awards (1) | Stock Awards (1) | |||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) (2) | Market Value of Shares or Units of Stock That Have Not Vested ($) (3) | ||||||||||||||||||

Gregory T. Mount (3) | 60,848 | 60,848 | 8.20 | 3/28/2026 | 0 | 0 | ||||||||||||||||||

John Russell | 0 | 0 | ||||||||||||||||||||||

Julie Shiflett | 88,000 | (4) | 323,840 | |||||||||||||||||||||

| 9,282 | (5) | 34,158 | ||||||||||||||||||||||

| 44,554 | (6) | 163,959 | ||||||||||||||||||||||

Gary Sims | 88,000 | (7) | 323,840 | |||||||||||||||||||||

| 8,663 | (5) | 31,880 | ||||||||||||||||||||||

| 41,584 | (6) | 153,029 | ||||||||||||||||||||||

Paul Sacco (8) | 0 | 0 | ||||||||||||||||||||||

| (1) | The vesting of unvested | |

| (2) | The value of these | |

| (3) | Mr. Mount left the Company on November 8, 2019. Per the terms of our Equity Incentive Plan and the award agreement for the options listed in the table above, the option expired on February 8, 2020 without exercise. |

| (4) | One-fourth of these |

One-fourth of these RSUs will vest | ||

| (6) | Represents the maximum amount of PSUs that can be issued if all performance measures were exceeded. The PSUs vest upon confirmation of achievement of the performance conditions set forth in the individual executive’s grant agreement by the Compensation Committee and, in addition, on continuous service through the vesting date of March 29, 2022. No PSUs vested in 2018 or 2019. |

15

| (7) | These RSUs will vest | |

| (8) | Mr. Sacco left the | |

23In 2019, as described in the table above, we provided long-term incentives to our executive officers in the form of (i) time-based restricted stock units (RSUs), with a vesting period of four years and (ii) performance-based restricted stock units, with a vesting provision based on achievement of certain performance goals plus a time based provision requiring continued service to the Company for an additional three years from grant date.

Under all of the RSUs granted to our executive officers in 2019, an executive will be entitled to receiveone-fourth of the shares subject to the award on each of the first four anniversaries of the date of grant as long as the executive remained continuously employed with us until the applicable anniversary.

Under the PSUs granted to our executive officers in 2019, anexecutive will be entitled to receive the shares subject to the award on March 29, 2022, at the target level, as long as prior to such date the performance conditions set forth in each executive officer’s grant are achieved, and the executive remained continuously employed with us until the applicable vesting date. The performance measure for the PSUs granted in 2019 related to fiscal year 2020 and 2021 EBITDA performance.

The performance measure for PSUs granted to our executives in 2018 related to fiscal 2019 EBITDA performance. Based on the Company’s reported EBITDA as of December 31, 2019, the performance conditions were not achieved, and therefore the PSUs issued to executives in 2018 were forfeited.

Additional Narrative Disclosure Regarding Compensation

The Compensation Committee of our Board, which is composed entirely of independent directors, as defined under NYSE rules, determines compensation for our executive officers. All decisions of the Compensation Committee are reported to our Board.

As a smaller reporting company, we may comply with scaled disclosure requirements, particularly in the description of executive compensation. The smaller reporting company rules do not require us to include a Compensation Discussion and Analysis, or CD&A, section in our proxy. Nevertheless, we believe it is important for our shareholders to understand our compensation objectives, policies and procedures, so we have elected to include in this proxy this additional discussion of our compensation program objectives and elements.

Compensation Program Objectives and Rewards

Our Company believes that our executive compensation program should:

Attract, motivate and retain highly qualified executives by paying them competitively, consistent with our success and their contributions to this success; and

Pay for performance by rewarding and encouraging individual and superior company performance, on both a short- and long-term basis, in a way that promotes alignment with long-term shareholder interests.

All of the compensation and benefits for our executive officers have as a primary purpose our need to attract, retain and motivate highly talented individuals who will engage in the behaviors necessary to enable us to succeed in our mission while upholding our values in a highly competitive marketplace. Beyond that, different elements are designed to engender different behaviors:

Base salary and benefits are designed to attract and retain executives over time.

Annual cash awards under an annual bonus plan for executive officers are designed to focus executives on one or more specific performance goals established each year by the Compensation Committee.

16

Long-term equity incentives focus executives’ efforts on the behaviors within their control that we believe are necessary to ensure our long-term success, as reflected in increases in our stock price over a period of years.

Severance and change of control arrangements are designed to facilitate our ability to attract and retain executives as we compete for talent in a marketplace where such protections are commonly offered. These arrangements ease an executive’s transition due to an unexpected employment termination. In the event of rumored or actual fundamental corporate changes, these arrangements will also allow executives to remain focused on our business interests.

Pay Practices

What We Do: | • Pay for performance • Balance short-term and long-term compensation to discourage short-term risk taking at the expense of long-term results • Put caps on incentive compensation • Subject variable pay to our clawback policy • Have double trigger change of control agreements • Set required stock ownership guidelines for executive officers • Pay competitively to attract and retain top talent • Engage independent consultants to review and advise on executive compensation | |

What We Don’t Do: | • Provide guaranteed minimum bonuses • Pay dividends on unvested or unearned incentive awards • Reprice or reload stock options without shareholder approval • Backdate options or grant options retroactively • Provide for automatic single-trigger vesting acceleration in connection with a change of control | |

The Compensation Committee has the sole authority and vestingresponsibility to select, retain, and terminate any adviser to assist it in the performance of stockits duties, and to approve the compensation consultant’s fees and terms of engagement. In 2019, the Committee continued to work with independent compensation consultant PayGovernance, which provided general consultation regarding our executive compensation and director compensation programs, including compensation for our interim CEO and all named executive officers.

Elements of Our Compensation Program

Base Salaries

The Compensation Committee determines base salaries for the executive officers early each year based on a variety of factors, including the following:

individual performance;

17

job responsibilities;

��

tenure with the company as well as prior experience;

economic conditions;

retention considerations; and

the competitive labor market, including regional salary levels and those of executives at other hospitality companies.

In determining the base salaries of executive officers, the Compensation Committee also solicits input from the CEO and takes into consideration the recommendations made by the CEO with respect to the compensation of the other executive officers.

The base salaries for our named executive officers for 2019 remained the same as the base salaries for 2018. As a general matter, the Company seeks to position its base salaries, target annual bonuses and long-term incentive compensation at or below the median of its peer group benchmark data (as adjusted to account for our smaller revenue size as compared to our peer group).

Bonus Plan and Other Annual Cash Awards

Each year the Compensation Committee establishes one or more performance goals for our executive officers under an executive officer bonus plan (the “Bonus Plan”), and the levels of cash awards that the executives will receive based on the extent to which their goals are achieved. The goals and award levels are set after extensive discussion between the Compensation Committee and the CEO regarding the performance needed to drive execution on the Company’s annual budget and its strategic plan. Company goals generally relate to the Company’s overall financial performance, and individual goals have been subjective or objective, but they have generally been based on performance in areas of our business that the Compensation Committee believed were important to our success. Award levels are specified as a percentage of base salary. The final performance goals and award levels are set by the Compensation Committee. The Compensation Committee determines the threshold, target and maximum award levels under the Bonus Plan based on the same factors that it considers in determining base salaries.

Under the Bonus Plan, there is an overriding discretionary analysis of each executive’s eligibility to receive variable pay. For example, if an executive failed to follow company policy and procedures, exposed the company to legal liability, or exhibited behavior inappropriate for a leadership position, the executive could have been disqualified from receiving variable pay, even if his or her specified performance goals had been achieved.

For 2019, the Bonus Plan had a threshold of 90% of target Adjusted EBITDA for 2019 (“Target Adjusted EBITDA”), which was required to be reached before any bonus would be paid. The Bonus Plan is structured so that if the threshold level of Target Adjusted EBITDA is achieved, then bonuses would be paid, with 80% of the executive’s eligible bonus payable based on the level of Target Adjusted EBITDA achievement, and 20% based on the executive’s achievement of departmental and individual goals. Departmental and individual goals are set for each executive, and include one or more department or individual goals based on applicable division or department performance such as gross operating profit; increases in revenue; addition of franchised hotels to the RLHC system; brand acquisitions; improvement in customer service competitive quality index; improvement in brand awareness index; and other goals that advance department or company strategic goals and/or personal development. The department and individual goals are established by the CEO and Compensation Committee.

In 2019, the Company did not achieve 90% of its Target Adjusted EBITDA, therefore no bonuses were paid under the Bonus Plan.

In addition to awards under the Bonus Plan, the Compensation Committee has authority to grant discretionary bonuses to executive officers based on performance not otherwise measured by the Bonus Plan or for other reasons. No discretionary bonuses were granted to our named executive officers for 2019.

18

Long-Term Equity Incentives

RSUs and PSUs. Since 2009, we have provided long-term incentives to our executive officers in the form of time-based restricted stock units (RSUs), typically with a vesting period of four years. We have done this in order to preserve the pool of shares available under our stock incentive plans, and because of a market trend to rely more heavily on RSUs than on stock options as long term incentives because RSUs provide more stable incentives for executives. The equity incentives are intended to benefit shareholders by enabling us to better attract and retain top talent in a marketplace where such incentives are prevalent. RSUs closely align our executives with the achievement of our longer-term financial objectives that enhance shareholder value. Under all of the RSUs granted to our executive officers in 2019, an executive was entitled to receiveone-fourth of the shares subject to the award on each of the first four anniversaries of the date of grant as long as the executive remained continuously employed with us until the applicable anniversary.

To further reflect ourpay-for-performance compensation philosophy, in 2018 the Compensation Committee elected to grant restricted stock units with a mix of both time-based RSUs and performance-based restricted stock units (PSUs). The Compensation Committee believes that the mix of time-vesting and performance-vesting equity awards achieves a balance in our equity-based incentive program that further aligns the interests of our executive team and our shareholders. Each set of performance measures is intended to reward the achievement of specific long-term strategic goals designed to deliver long-term shareholder value. The length of the performance period, the mix of time and performance-based awards, the specific performance measures and target levels, and the time-based vesting provisions are established each year by the Compensation Committee.

The mix for 2019 was 75% PSUs and 25% RSUs. Each PSU has a minimum, a target and a maximum share amount based on the level of attainment of the performance condition(s) with payouts of 25% to 50% at the minimum, 100% at the target, and 160% at the maximum. The PSUs granted in 2019 were tied to the achievement of certain financial and operational performance goals measured over fiscal years 2020 and 2021. In addition, each PSU has a further time vesting provision requiring continued service to the Company of three years from the date of grant. The Compensation Committee believes PSU grants align our executive’s compensation with meeting or exceeding key financial and operational performance goals that will deliver long-term value to our shareholders, and will further motivate our executive team to achieve our key business objectives.

The performance measure for PSUs granted to our executives in 2018 related to fiscal 2019 EBITDA performance. Based on the Company’s reported EBITDA as of December 31, 2019, the performance conditions were not achieved, and therefore the PSUs issued to executives in 2018 were forfeited.

The Company has in the past awarded stock options to executives, although no stock options were granted to executives in 2018 or 2019. When granting stock options, the Company’s policy is to set the exercise price of our stock options at fair market value, which is the closing selling price of our common stock on the NYSE on the grant date.

Say on Pay Voting Results

At last year’s annual meeting, we asked our shareholders to approve, on an advisory basis, the compensation of our named executive officers disclosed in the proxy statement for that meeting. We hold this advisory shareholder vote every year.

Red Lion has historically received strong support from our shareholders regarding our executive compensation programs, averaging over 90% in favor during 2014 through 2018, including 98% support in 2018. In 2019, we saw our approval rating decline to 61.3% of the votes cast on that proposal approving the compensation. Our proposal at our 2019 meeting to increase the number of shares authorized for issuance under our existing stock incentive plan also received less for votes than against votes, and was not approved. Although Red Lion was already engaged in active engagement with our shareholders, we focused our outreach during the remainder of 2019 and into 2020 to ensure shareholder input was included in our planning process for our 2020 compensation program.

19

During the third and fourth quarters of 2019, we engaged in active communication with and solicited feedback from shareholders holding approximately 50% of our outstanding shares to discuss the strategic direction of our company, our corporate governance and executive compensation matters. Our shareholder engagement team included our Chairman of the Board, and members of our management team, including our CEO and CFO, all of whom met with shareholders to better understand the reasons behind the lower say on pay vote and no vote on the amendment to our stock incentive plan. This outreach has continued into 2020 with current Chairman of the Board R. Carter Pate. We heard from shareholders that excessive dilution associated with stock awards to management was a concern. The Compensation Committee will use this feedback from shareholders as we continue our search for a permanent Chief Executive Officer and design and set compensation for our new chief executive, and in making modifications to our incentive plan structure and incentive compensation on a going forward basis.

Clawback Policy

The Compensation Committee has adopted a Compensation Clawback Policy (the “Clawback Policy”) that gives the Compensation Committee authority to recoup certain executive officer compensation in the event of financial errors, including an accounting restatement, or other executive officer conduct that adversely affects our company or its results of operation. The Clawback Policy applies to all incentive compensation paid, granted, earned, vested or otherwise awarded to an executive officer, including annual bonuses and other short and long term cash incentive awards, stock options, restricted stock awards and other equity or equity-based awards.

Stock Ownership Guidelines

Our Board of Directors has adopted Stock Ownership Guidelines applicable to our directors and executive officers. Share ownership demonstrates to our shareholders, the investing public and the rest of our company’s associates, our executive officers’ commitment to our company and directly aligns executives’ interests with those of our shareholders. Each of our CEO, CFO, Executive Vice Presidents and General Counsel is required to own the lesser of either (i) 30,000 shares of our common stock, or (ii) a number of shares of our common stock equal in value to at least his or her annual base salary. Each of our executives has four years from the date of his or her appointment to attain such level of ownership. Our executives are in compliance with our Stock Ownership Guidelines or are still within the four year ended December 31, 2010.

| Option Awards | Stock Awards | |||||||||||||||

| Number of | Number of | |||||||||||||||

| Shares | Shares | |||||||||||||||

| Acquired | Value Realized | Acquired | Value Realized | |||||||||||||

| on Exercise | on Exercise | on Vesting | on Vesting | |||||||||||||

Name | (#) | ($) | (#) | ($) (1) | ||||||||||||

| Jon E. Eliassen | 0 | 0 | 0 | 0 | ||||||||||||